Wall Street Bets AI Euphoria Will Push S&P Up 20%

Artificial intelligence (AI) is no longer just a tech buzzword; it is shaping how we live, work, and invest. Lately, we have seen a wave of AI euphoria on Wall Street, fueled by the belief that AI could transform entire industries. Investors, both big and small, are talking about AI as the next big growth engine. On social media platforms like Wall Street Bets, discussions about AI stocks are trending like never before. We see people sharing tips, predictions, and even memes, all betting that AI will push markets higher.

Some analysts now suggest that the S&P 500 could climb as much as 20% due to this AI optimism. We find this fascinating because it shows how investor sentiment can influence the broader market. But while the excitement is real, we also need to understand the risks behind it.

Are these gains built on strong fundamentals, or are they fueled by hype and hope? In this article, we explore why AI is creating such a buzz, how retail investors are joining the trend, and what it could mean for the S&P 500 in the months ahead.

AI Euphoria in the Stock Market

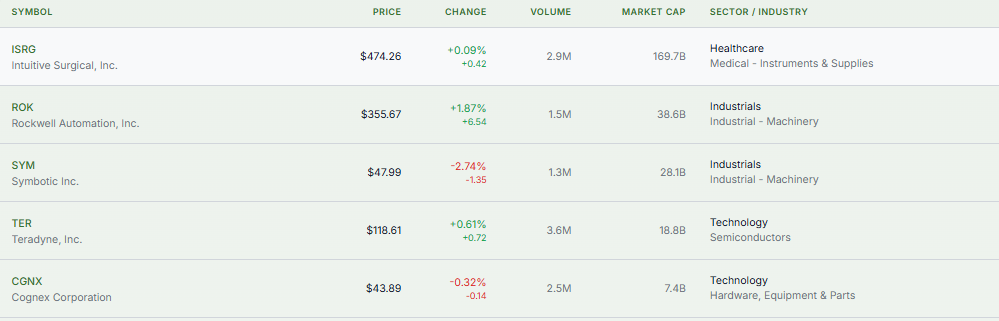

Artificial intelligence (AI) has grown from a specialized tool into a major force in industries like healthcare, finance, and manufacturing. This rapid adoption has created what analysts call “AI euphoria,” a surge in investor optimism and speculative buying of AI stocks.

The excitement shows in companies like Nvidia, whose chips power AI systems. Its market value has jumped as demand for AI infrastructure rises. Similarly, Meta and Microsoft report strong gains from AI development and strategic investments.

AI enthusiasm also extends to smaller firms. CoreWeave, an AI data center operator, has seen its stock climb, showing investors’ appetite for AI-focused businesses.

Yet, caution is necessary. The fast inflow of money into AI ventures can cause overvaluation and create risks. Investors should carefully evaluate whether companies can meet high expectations and sustain growth over the long term.

Wall Street Bets and Its Influence

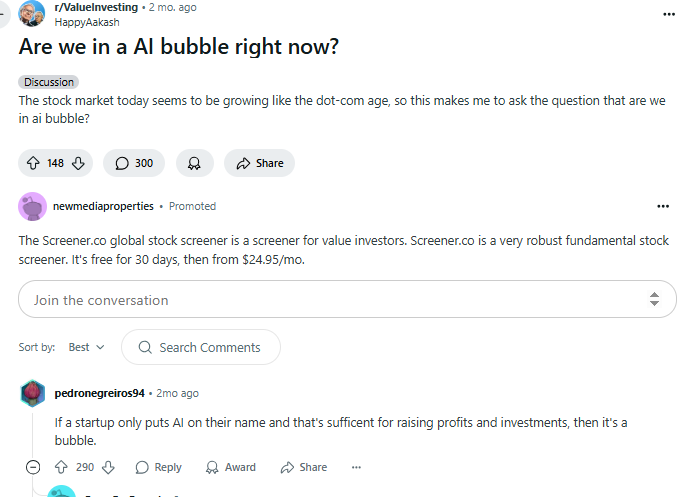

Wall Street Bets (WSB), a Reddit community, has changed how stocks move, especially during high speculation. Recently, it has focused on AI stocks, boosting market excitement.

WSB members actively discuss and invest in AI companies. Their actions increase volatility and push stock prices up quickly. The community can rally many retail investors, often driving short-term price swings that do not reflect a company’s fundamentals.

WSB’s influence can bring big gains, but it also carries risks. Rapid price changes can create profit opportunities, but investors may face losses too. The attention on AI stocks shows growing retail interest, yet it also highlights the need for careful research and caution before trading in these volatile markets.

Why Analysts See a 20% Upside for S&P?

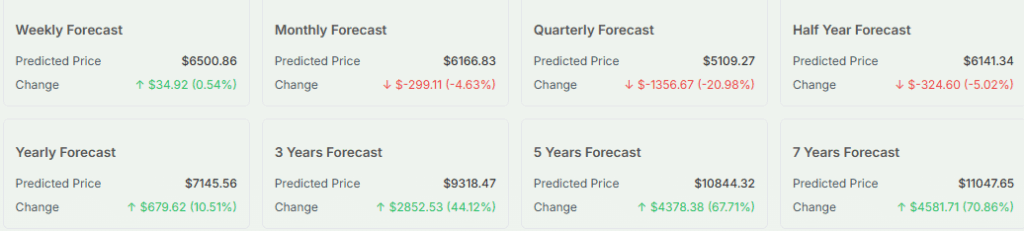

Analysts expect the S&P 500 to rise about 20% by the end of 2026, driven largely by the AI boom. Evercore ISI predicts the index could reach 7,750 points. They compare AI’s impact to the internet boom of the late 1990s, but note AI may have an even bigger influence across industries.

Bank of America offers a more ambitious forecast. They expect the S&P 500 to hit 9,914 by September 2027, a 52.5% jump from current levels. Their outlook assumes interest rate cuts, continued AI growth, and possible economic stimulus in 2026.

Overall, analysts agree that AI will strongly influence market growth. Still, these forecasts depend on economic policies, technological progress, and global market conditions. Investors must weigh these factors carefully to judge whether the projected gains are realistic and sustainable.

Risks and Cautions

The AI-driven market rally comes with clear risks. Overvaluation tops the list. Fast inflows of money into AI stocks can push prices beyond real value. This makes market corrections more likely if companies fail to meet high expectations.

Another concern is investment concentration. A few AI-focused companies dominate the market. Any setbacks in these firms can ripple across the broader market.

Regulations add more uncertainty. Governments are increasing scrutiny of AI, focusing on ethics, privacy, and monopoly risks. New rules could slow growth or change business models, affecting profits and stock prices.

Investors should balance excitement with caution. Spreading investments, researching carefully, and planning for the long term can reduce risks while allowing participation in AI’s growth potential.

Lessons from Previous Market Hypes

The current AI euphoria bears resemblance to past market phenomena, such as the dot-com bubble and the electric vehicle (EV) craze. In the late 1990s, the internet revolution led to a surge in tech stock valuations, many of which were unsustainable. This results in a significant market correction.

Similarly, the recent EV boom saw inflated valuations for companies with promising technologies but unproven business models. While some EV companies have succeeded, others have faltered, leading to substantial investor losses.

These historical examples underscore the importance of cautious optimism. While emerging technologies like AI offer substantial growth potential, investors must critically assess the viability and sustainability of companies within these sectors. Overzealous investment driven by hype can lead to significant financial losses.

Wrap Up

AI excitement is shaking the stock market, offering both big chances and clear risks. Investors can earn high returns, but they must stay alert and make smart choices. Experts predict the S&P 500 could rise 20% in 2026, driven by AI innovations. Still, overvalued stocks, market concentration, and changing regulations can create setbacks.

A strong investment plan should focus on spreading risk and researching every move carefully. Learning from past market bubbles helps investors avoid mistakes. Those who act thoughtfully can tap AI’s growth potential while avoiding the pitfalls of speculation.

Frequently Asked Questions (FAQs)

Yes, Meyka’s predictive AI tools forecast the S&P 500 index could rise to approximately 6,300 by the end of 2025, reflecting a 5% increase from current levels. Additionally, Evercore ISI projects the S&P 500 could reach 7,750 points by the end of 2026, a 20% increase, driven by AI’s transformative impact across industries.

Wall Street Bets has shifted focus to AI stocks, amplifying market movements through collective retail investor actions, highlighting the growing influence of social media-driven investment strategies.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.