Wealthsimple Gold Trading: Platform Hits $100B Milestone, Launches Advanced Tools

On October 22, 2025, Wealthsimple announced a major milestone: the platform now oversees over C$100 billion in assets under administration. Alongside that achievement, the company introduced a set of advanced investment tools signalling a shift from simple trading and robo-advising to a full-scale, sophisticated investing experience. These tools include access to physical gold trading, enhanced options strategies, and more personalized portfolio features.

For everyday investors, that means the same platform they used for easy stock trades is now offering features once reserved for high-net-worth clients. This evolution underscores a broader trend: democratizing investing by making advanced asset classes and strategies available to more people.

Let’s find out what the milestone means, what new tools are being launched, and how all this could impact investors and the market at large.

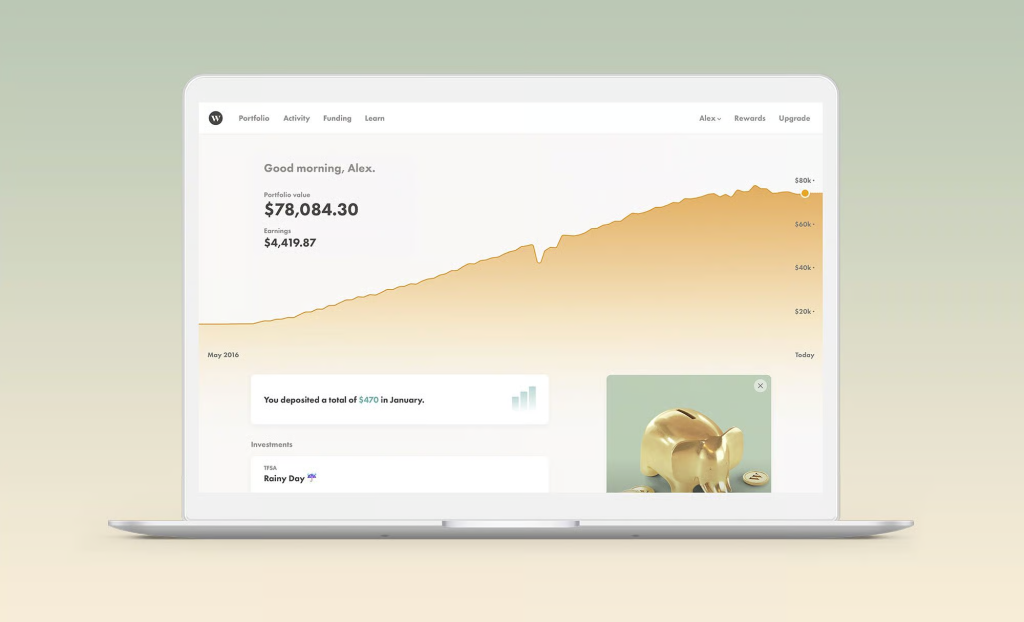

Wealthsimple Background and Company Evolution

Wealthsimple began in 2014 as a simple robo-advisor. The brand grew fast. It moved from automated portfolios into a full digital wealth platform. Over time, the product range expanded. The platform now offers managed portfolios, self-directed trading, crypto, tax tools, and banking-like accounts. This growth set the stage for a bigger push into advanced investing features and alternative assets.

What does the $100-billion Milestone mean?

Hitting C$100 billion in assets under administration on October 22, 2025, marks a major turning point. It shows strong client trust. It also gives the company more room to lower fees and add new services. Scale helps with negotiating custody, listing new assets, and funding product development. For users, the milestone means access to offerings that used to be available only to large brokerages or wealthy clients.

The New Advanced Tools at a Glance

The platform now includes features aimed at more experienced investors. Options trading moved to a zero-commission model. That includes no per-contract fees for basic options orders. Self-directed investors can trade stocks and ETFs with no commissions. Margin rates and research tools also got attention. The company announced an AI-driven research and trading dashboard to help with idea generation and trade execution.

One mention of an AI research analysis tool appeared as part of the product narrative. These changes shift the platform toward active traders and portfolio builders who need low costs and better data.

Deep Dive: Gold Trading Offering

A notable addition is the ability to buy fractional ownership of physically backed gold. Users can buy small amounts, with purchases starting at low dollar amounts. Trades settle in Canadian dollars and can be accessed inside existing Wealthsimple accounts. The platform offers 24/7 pricing and real-time execution for gold. Physical coin redemption is planned to begin in November 2025, giving clients an option to take delivery of minted coins. This opens a direct route to bullion that many retail investors did not have before.

The gold product mixes convenience with custody. The bullion is held by third-party storage providers. Fractional ownership removes the need for private storage at home. That reduces some security worries. However, physical custody adds operational complexity. Clients should compare premiums, storage fees, and liquidity to other gold exposures like ETFs.

Pricing Moves and Limited-time Offers

To accelerate adoption, Wealthsimple announced promotional pricing for gold trading. A spread fee offer began on October 22, 2025, with a 0% spread for eligible accounts for a limited time. The broader fee structure for gold trading is competitive compared with Canadian peers, and the company highlighted low ongoing rates for crypto and options, too. These moves aim to lower the cost of trading across asset classes and attract active customers who care about fees.

Risks and Investor Considerations

New features add choice. They also increase complexity. Options trading, direct exposure to physical gold, and self-directed strategies demand investor knowledge. Options can magnify losses. Physical gold has storage and liquidity trade-offs.

Zero commissions can encourage higher turnover, which may increase tax events and bid-ask costs. Investors should read product terms, understand custody arrangements, and consider how each tool fits a long-term plan. Clear education and risk disclosures are vital.

Market and Competitive Impact

This product expansion will pressure traditional Canadian brokerages. Zero-commission options and 24/7 gold trading are moves that could pull active traders away from legacy providers. Competitors may be forced to match fees or improve their own platforms.

The larger industry could see faster innovation as scale and fintech capabilities combine. Regulators and market participants will watch operational readiness closely. Clearing, custody, and settlement for a physically backed, always-open product raise new questions for oversight.

What to Watch Next on Wealthsimple?

Monitor actual rollouts and fine print. Watch the coin redemption launch in November 2025 for practical details about delivery fees and wait times. Track the adoption rates for options and gold. Also note upcoming AI features and any limits on advanced strategies.

Finally, watch margin and financing rates. They matter for active traders who use leverage. Transparency on custody and reporting will guide how comfortably investors accept physical-asset features in a retail app.

Wrap Up

The C$100 billion milestone on October 22, 2025, and the new suite of tools show a deliberate shift. The platform now blends low-cost trading with access to real assets. That combination widens the choice for retail investors.

It also raises the bar for user education and platform reliability. Those who choose to use these features should study the terms closely. New tools can add value. But they also require responsibility and a clear plan.

Frequently Asked Questions (FAQs)

Wealthsimple Gold Trading, launched on October 22, 2025, lets users buy small amounts of real gold in Canadian dollars with secure storage and optional physical delivery.

Wealthsimple reached C$100 billion in assets under administration on October 22, 2025, marking a major milestone for the Canadian investing platform’s growth and expansion.

Wealthsimple’s new tools follow Canadian regulations and include risk controls. Still, users should learn how each feature works before investing in options or gold

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.