What Sets Leading AI Financial Chatbot Developers Apart

AI is changing finance fast. Banks, wealth managers, and fintechs now use chatbots to automate tasks, serve customers, and deliver insights. AI financial chatbot developers build these systems. They blend language models, data pipelines, and domain rules to solve real business problems.

Why are AI chatbots becoming a core part of financial enterprises today? Because they scale service, reduce costs, and improve decision-making with data-driven answers.

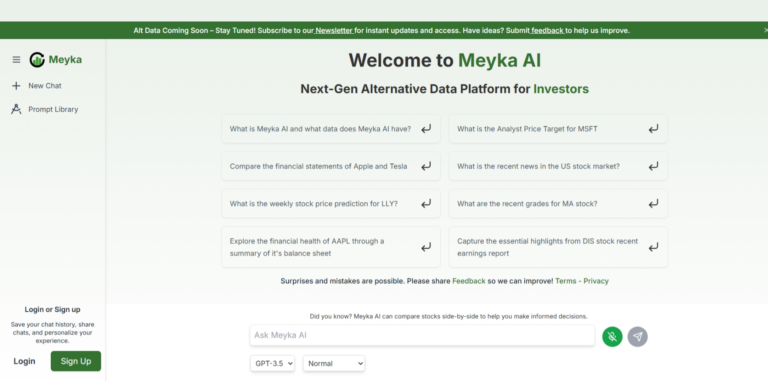

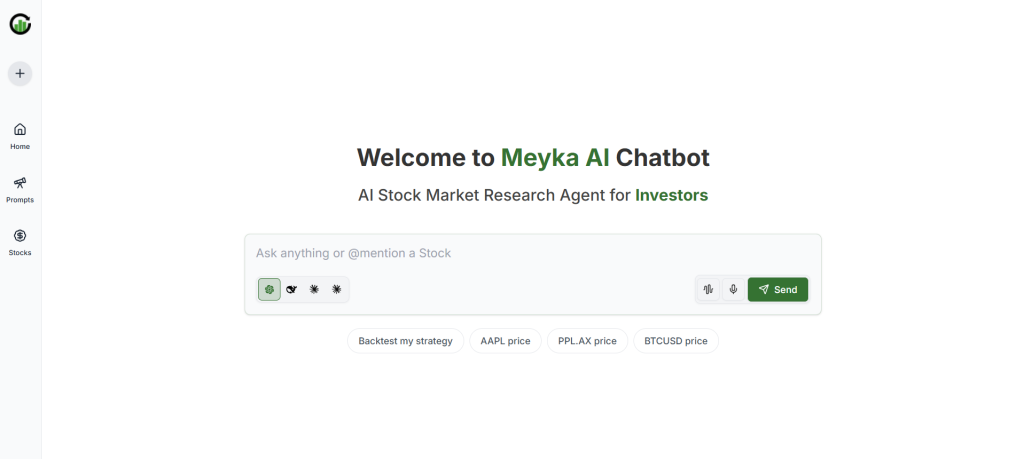

Meyka is an enterprise AI development firm that focuses on financial assistants, automation workflows, and LLM-powered solutions. Meyka helps banks and funds deploy secure chatbots that handle product queries, transactions, compliance checks, and portfolio analysis.

The AI in the financial services market is projected to surpass $40 billion by 2030, driven by automation and LLM innovation, and top developers are at the center of this shift.

Understanding the Role of AI Financial Chatbot Developers

AI financial chatbot developers design intelligent systems that understand customer intent, run financial logic, and connect to back-end systems. They use machine learning, natural language processing, and large language models to interpret questions, fetch data, and act on behalf of users.

Top teams work with cloud providers, model vendors, and enterprise data platforms like OpenAI, Google Cloud AI, and Meyka’s proprietary LLM-powered financial models.

What makes AI chatbots so effective in finance? They deliver 24/7 assistance, automate repetitive tasks, and provide fast, accurate insights that free human advisors to focus on complex work.

What developers actually build

- Conversational front ends for banking and investing

- Automated workflows for KYC and account opening

- Portfolio assistants who report holdings and performance

- Advisor bots that surface trade ideas and alerts

What Sets the Best AI Financial Chatbot Developers Apart

The leaders combine finance knowledge with engineering discipline. Below are the traits that separate top firms from the rest.

1. Domain Expertise and Financial Knowledge

Developers must know finance, regulation, and customer behavior. Leading teams embed compliance checks, accounting rules, and investment logic into chatbots. Meyka combines financial domain expertise with AI engineering to create bots that understand trade rules, tax treatments, and portfolio risk metrics.

- AI-driven financial assistants perform portfolio queries and regulatory checks.

- Intelligent banking chatbots handle payments, balances, and dispute workflows.

- AI-powered investment advisors can screen stocks and generate watchlists.

2. Customization and Scalability for Enterprises

Enterprise clients expect tailored solutions. The best developers offer modular platforms that adapt to retail banking, wealth management, or corporate treasury. Meyka’s solutions scale to thousands of concurrent users while preserving security and latency SLAs.

They support multi-tenant deployments, role-based access, and fine-grained audit trails.

3. Security, Compliance, and Ethical AI Practices

Security is non-negotiable. Developers follow enterprise-grade encryption, role-based access, and standards such as ISO and SOC. They embed GDPR and data governance into design. Meyka uses privacy-preserving architectures, secure model hosting, and transparent audit logs to meet compliance and ethical AI standards.

4. Integration with Existing Enterprise Systems

Top developers deliver API first platforms that connect to CRM, ERP, core banking systems, and market data feeds. Meyka provides adapters for FinTech stacks, trading platforms, and accounting systems, enabling chatbots to execute transactions and reconcile data without re-platforming core systems.

5. Use of LLM and NLP for Financial Intelligence

LLMs enable deeper reasoning and context-aware responses. Meyka leverages LLM fine-tuning for financial corpora, enabling bots to explain portfolio attribution, tax impact, and scenario analysis. Their LLM-backed chatbots perform advanced tasks like automated research summarization and trend detection.

- Example: Meyka chatbots assist in AI Stock research, scanning filings and news for signals.

- Use case: Automated briefing notes for portfolio managers.

The Market Growth of AI Financial Chatbot Development

The market is expanding quickly. Banks and fintechs invest in AI to cut costs and improve retention. Investors see developers as key players in digital transformation. Chatbots reduce call center volumes, accelerate onboarding, and create upsell channels.

Why are investors interested in this market? AI chatbots lower costs, increase customer lifetime value, and open new fee streams through value-added services and personalized advice.

Key industry stats:

- Rapid CAGR for AI in financial services

- Rising enterprise budgets for AI and automation

- Increased demand for LLM-powered analytics and conversational UX

How Meyka Leads the AI Financial Chatbot Development Space

Meyka combines enterprise readiness with AI innovation. The firm builds tailored chatbots for banking, wealth, and corporate finance, focusing on speed to market and long-term ROI. Learn more at Meyka’s enterprise pages: Meyka AI, Meyka Enterprise, Meyka About.

Meyka’s Core Strengths

- Enterprise-grade customization for banking, investment, and analytics

- Intelligent automation that reduces manual research tasks and query load

- AI Stock Analysis integration to support portfolio teams with near real-time insights

- Scalable LLM platforms that serve global banks and fintechs

Client Benefits and Market Opportunities

- For investors: Exposure to fast-growing enterprise AI services with attractive margins

- For enterprises: Better customer experience, faster issue resolution, and data-driven decision making

- Meyka helps clients leverage AI Stock tools to improve investment workflows and alert generation

Real-world example of Meyka’s impact

A mid-sized wealth manager implemented Meyka’s chatbot to automate portfolio reporting and client queries.

The result: 70 percent reduction in query resolution time, higher client satisfaction, and 20 percent lower operational cost in the investor servicing team. With Meyka, enterprises see both cost reduction and growth acceleration.

The Future of AI Financial Chatbot Developers

The next wave includes multimodal assistants, voice-enabled bots, and emotionally aware AI. Meyka invests in LLM fine-tuning, real-time analytics, and explainable AI to meet these trends.

Will AI chatbots replace human advisors? Not completely. They automate routine work and surface insights, freeing human experts to focus on strategy and complex client interactions.

Trends to watch:

- Multimodal AI assistants for documents, charts, and voice

- Advanced forecasting and scenario planning in chat flows

- Emotion-aware interfaces for richer client interactions

Why Enterprises Choose Meyka for AI Financial Chatbot Development

Enterprise Ready Performance

Meyka focuses on speed, accuracy, and uptime. Their systems process millions of data points and deliver fast, contextual answers for enterprise clients.

Proven Factors

- Experience: Years of AI and financial automation work

- Expertise: Teams of data scientists, quants, and engineers

- Authority: Enterprise deployments across regions and compliance regimes

- Trust: Transparent AI practices and secure cloud operations

Competitive Advantage

Meyka stands out with rapid deployment timelines, high NLP accuracy, human-centric dialogue design, and tight integration with enterprise workflows.

Geo and Semantic Optimization

Meyka’s services are GEO optimized for the US, Europe, and Asia Pacific, offering localized compliance and language support for multinational clients.

Conclusion: Redefining the Future of Financial Intelligence

AI financial chatbot developers are reshaping the finance industry by combining conversational AI, compliance, and deep domain knowledge. Meyka stands out for its enterprise-grade solutions, LLM-powered intelligence, and secure integration capabilities.

Enterprises and investors seeking stable returns from AI in finance will find value in platforms that deliver measurable automation, better customer experiences, and faster decision-making.

Explore Meyka’s enterprise services for tailored AI chatbot development and automation: https://meyka.com/contact-us/. In a world where AI is redefining financial intelligence, Meyka helps enterprises move faster, think smarter, and grow stronger.

FAQ’S

They build intelligent chatbots for banks and investment firms to automate queries, transactions, and analytics.

They improve efficiency, cut service costs, and offer data-driven insights using LLM-powered automation.

Meyka blends AI innovation, financial domain knowledge, and enterprise scale to deliver reliable, compliant solutions.

Yes, Meyka integrates AI Stock research tools that help enterprises analyze market trends.

They cannot predict perfectly, but they use data patterns and machine learning to improve decision-making and risk assessment.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.”