Why Christmas Treats are 70% More Expensive This Holiday Season, According to Which?

Christmas shopping this year feels different. In December 2025, many shoppers in the UK are seeing big rises in prices for holiday sweets and treats. According to consumer watchdog Which?, some festive chocolates and seasonal snacks are now up to 70% more expensive than they were last year.

Walk into a supermarket, and you can see it for yourself. Boxes of chocolates that cost a few pounds in 2024 now cost much more in 2025. These steep price jumps are hitting wallets at a time when families are already trying to balance tight budgets.

This is not just about higher numbers on price tags. It affects the small joys of the season, the Christmas chocolates, candy, biscuits, and festive treats that many of us look forward to all year round.

Let’s explore what Which? found and why this Christmas feels so much more expensive for sweet lovers and families alike.

What Exactly Did Which? Find? Breaking Down the 70% Claim

In December 2025, the UK saw unusual rises in Christmas treat prices. A new report from Which? shows that some seasonal items, especially festive chocolates, have jumped by more than 70% compared with last year. Popular brands like Lindt had huge spikes; for example, some chocolates were up over 70% year‑on‑year. These figures come from Which?’s latest price checks on products in supermarkets across Britain.

This 70% increase is not an average across all Christmas food. It represents the highest spikes seen on selected chocolates and treats. Many items rose far less, and some even stayed similar to last year’s price. Even so, the big jumps in sweets and chocolates stood out more than other categories, like meat or vegetables.

Which? compares identical products from one year to the next to show real changes. These comparisons include items like seasonal biscuits, favour boxes, and chocolate gifts. The group’s consumer inflation tracker highlights how much more shoppers now pay to get the same festive treats.

Shrinkflation: Paying More for Less at Christmas Treats

One hidden reason behind rising festive treat costs is shrinkflation. This is when brands reduce product size or weight but keep prices the same or higher. That means customers pay more per gram. The last few years have seen this happen in sweets and chocolate products.

For example, favourite seasonal chocolates sometimes contain fewer pieces than before, yet the price is higher. This trend makes price tags look less shocking on the surface, even though the unit cost increases sharply. Supermarkets often highlight the total price rather than the price per 100g, making shrinkflation easier to miss for shoppers.

This tactic is common in treats because brands know people are less price‑sensitive during the holidays. Shoppers want festive products and may not compare weights or sizes carefully. As a result, shrinkflation becomes a way to protect profits without obvious sticker shock.

Cocoa, Sugar, and Butter: The Hidden Global Crises Behind Your Treats

Another key driver of high Christmas treat prices is raw ingredient cost increases. Cocoa, which is essential for chocolate, has faced years of supply problems. Poor weather, crop disease, and climate effects in West Africa have reduced global cocoa production. The result is less supply and higher global cocoa prices.

Sugar and dairy costs have also risen. Butter is tighter in supply due to poor weather in major producing regions and a shift toward selling cream rather than turning it into butter. These high ingredient costs push up the cost of making chocolate and other festive baked goods.

Energy costs for factories and transport add further pressure. Food manufacturing uses a lot of energy, and higher wholesale gas prices make it more expensive for producers to run equipment and heat facilities. This adds to the final price of treats on supermarket shelves.

Supermarket Strategy: Why Christmas Is the Perfect Time to Raise Prices

Supermarkets know that demand for festive treats stays strong even when the economy feels tight. Families still want chocolates, biscuits, and special snacks to create holiday memories. This means retailers can raise prices without losing many customers.

Retailers often use loss‑leader pricing on staples like vegetables or meat to attract shoppers, then charge more on high‑margin seasonal items. Discounts are common on basics, but festive treats get less price competition. Many stores also offer “loyalty card” deals that seem like savings but mainly benefit frequent shoppers rather than dropping standard prices.

This strategic pricing reflects retail psychology. Shoppers expect to spend more at Christmas and are focused on tradition rather than budgets. That allows supermarkets and brands to push up prices without scaring off customers too much.

Branded vs Own‑Label: Who’s Increasing Prices Faster?

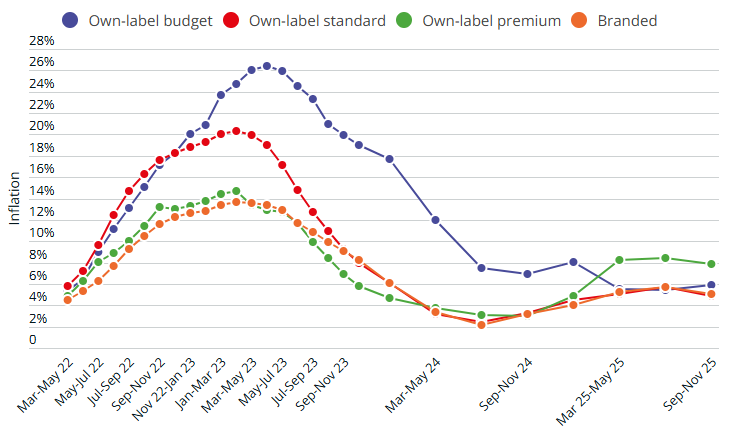

Price rises have hit both branded products and own‑label ranges, but not equally. Big-name chocolates often show steeper percentage increases than store-brand alternatives. For example, some branded boxes of festive chocolates saw price hikes well above typical food inflation.

Own‑label products usually rise less, but they still go up as ingredient and production costs increase. Despite often better value per gram, these lower‑cost options still cost more than in past years. Some supermarkets have expanded premium own‑label Christmas lines that sit between cheap basics and expensive brands, filling consumer demand while commanding higher prices.

The combination of brand premium and market positioning means shoppers must compare not just prices, but value per weight and product quality to decide what to buy.

How Much Extra are Families Really Paying This Christmas?

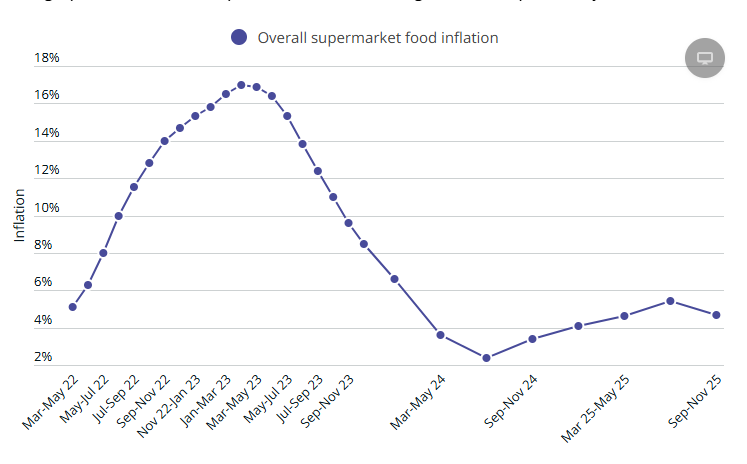

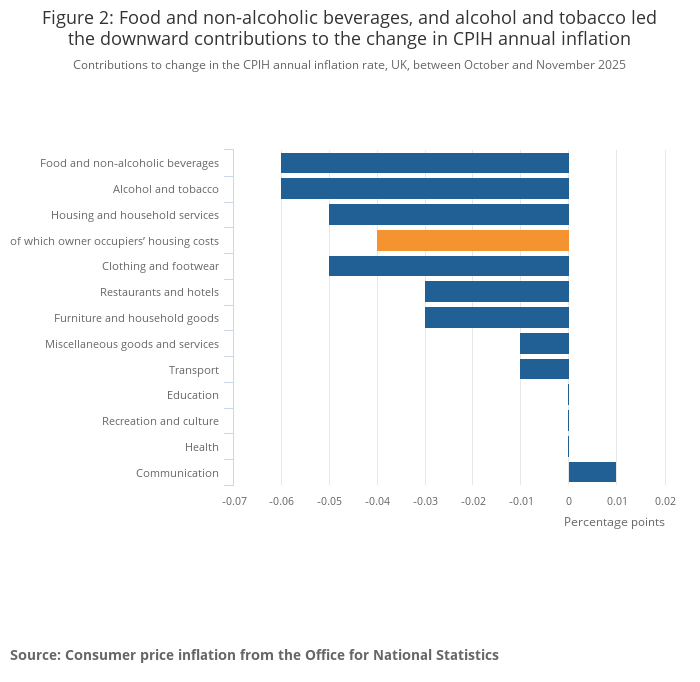

Overall food price inflation in the UK was higher than average in 2025. Food and drink prices hit a peak around mid‑year, with some staple categories showing double‑digit increases. Chocolate alone rose much faster than general grocery inflation.

The steep treat price jumps mean families may spend more on festive snacks even if they try to reduce spending on main meals. Some items, like beef roasting joints and cranberry sauce, also rose sharply, though others showed smaller increases.

This means a typical Christmas food basket can cost more than last year, especially if shoppers include premium treats and chocolates. Rising costs add to household budgets already stretched by other living expenses.

Which?’s Advice: How to Beat Christmas Treat Inflation

Which? offers tips for saving money without missing out on festive joy. Always check the price per 100g so shrinkflation doesn’t disguise value. Compare similar products across stores before buying.

Look out for special offers on festive food earlier in the season rather than waiting until peak demand. Buying own‑label or mid‑range products often costs less than premium brands.

Using price comparison tools and apps can help track real savings. And shopping at budget‑friendly chains often yields lower treat prices than high‑end supermarkets.

Is This the New Normal for Christmas Food Prices?

Prices are shaped by global supply chains and climate‑linked ingredient shortages. Cocoa production, for example, has fallen significantly over recent years, pushing up chocolate costs for all occasions, not only Christmas.

Although general inflation may be easing in late 2025, seasonal treats still show above‑average increases. This suggests festive price spikes might persist, especially if ingredient markets remain tight.

As a result, shoppers may need new strategies each year to keep festive costs under control. Awareness of price drivers, careful comparison, and flexible choices can matter more than simply chasing discounts.

Conclusion: The True Cost of Festive Indulgence

Christmas treats may cost more in 2025 because of bigger, structural changes in global food markets and retail pricing strategies. A 70% increase in some items is real, but it reflects only the highest spikes, not a universal rise.

Understanding why prices jump helps shoppers feel less blindsided. Smart choices and careful budgeting can make the season bright without overspending on treats that have become unexpectedly costly.

Frequently Asked Questions (FAQs)

Christmas chocolates are more expensive in 2025 because cocoa, sugar, and butter prices rose. Shrinkflation and energy costs also increased production prices, pushing supermarket prices higher.

Some branded chocolates, festive tubs, and special biscuits saw price jumps up to 70% in 2025. Own-label treats rose less, but most seasonal sweets cost more than last year.

Shoppers can save by comparing prices per 100g, choosing own-label products, buying early, or using discounts. Careful shopping avoids paying more for smaller sizes.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.