Why Klarna IPO Valuation Fell 70% in Just a Few Years

Klarna is one of the biggest names in the world of online payments. Founded in Sweden in 2005, it promised a new way to shop: buy now and pay later. This idea caught on fast. Millions of people started using Klarna to shop without paying up front. The company grew quickly, and so did its value. At one point, Klarna was worth over $45 billion. But things have changed a lot since then. Now, as Klarna plans to go public with an IPO, its value has dropped by nearly 70%. This is a huge fall in just a few years.

So, why did Klarna’s valuation drop so much? What happened to this fintech giant?

Let’s explore the main reasons behind Klarna’s sharp decline in value. We’ll look at the challenges it faced, from tough markets to new rules and money problems. We’ll also see what this means for Klarna’s future and its upcoming IPO.

Klarna’s Rise to Prominence

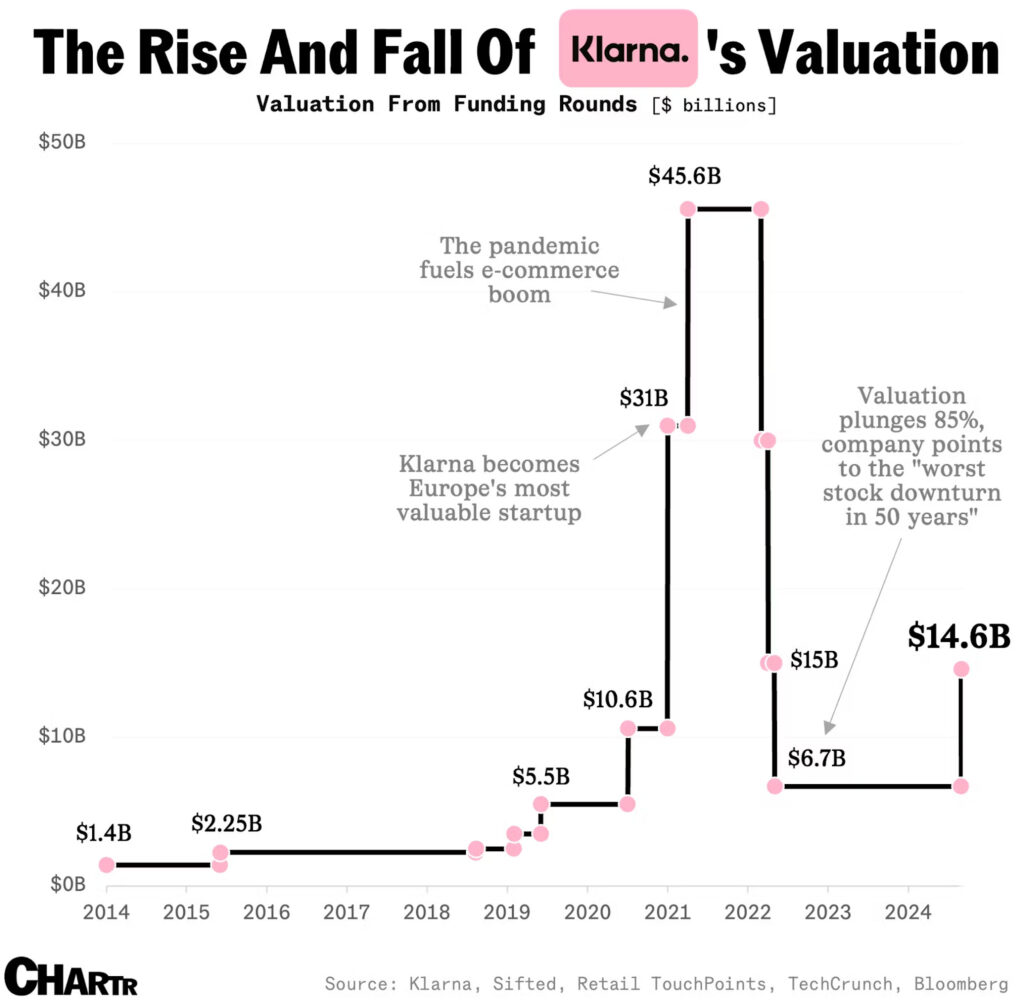

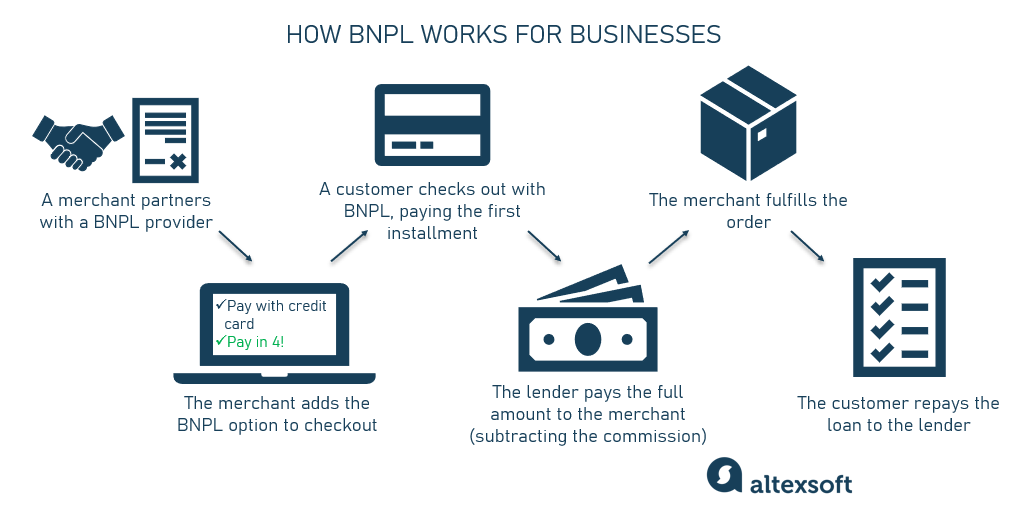

Klarna began in Sweden in 2005, quickly becoming a leader in the fintech space by offering a new shopping method called “buy now, pay later” (BNPL). This approach allowed customers to shop and pay in installments, without immediate payment. It became popular fast, especially among younger buyers and online retailers eager to offer flexible payments. Klarna’s fast growth attracted millions of users worldwide and made it one of Europe’s highest-valued startups. Investors were excited by its rapid expansion and disruptive model, propelling the company to a peak valuation of $45.6 billion in 2021, marking it a fintech superstar.

The Peak Valuation at $45.6 Billion

The valuation spike was driven by several factors. Klarna’s wide merchant network and strong user growth impressed investors. The company’s rapid expansion in the U.S. and other markets, fueled by heavy investments, showcased aggressive ambitions. A big funding round led by SoftBank in 2021 set Klarna’s valuation near record highs for fintech companies, with hopes that it could transform financial services globally.

The Onset of Challenges Leading to Valuation Drop

From 2022 onwards, several challenges began pushing Klarna’s valuation down. The end of ultra-low interest rates increased borrowing costs for fintech companies dependent on cheap capital. Inflation and economic uncertainty raised concerns about consumers’ ability to repay debts, especially in a slow economic environment.

On top of this, new regulations emerged, tightening the rules around BNPL services to protect consumers against overspending and debt risks. Klarna had to comply by changing its lending and marketing practices, which slowed growth. Market volatility and geopolitical tensions, like tariffs, caused further disruption and postponed its IPO plans.

Financial Performance and Profitability Issues

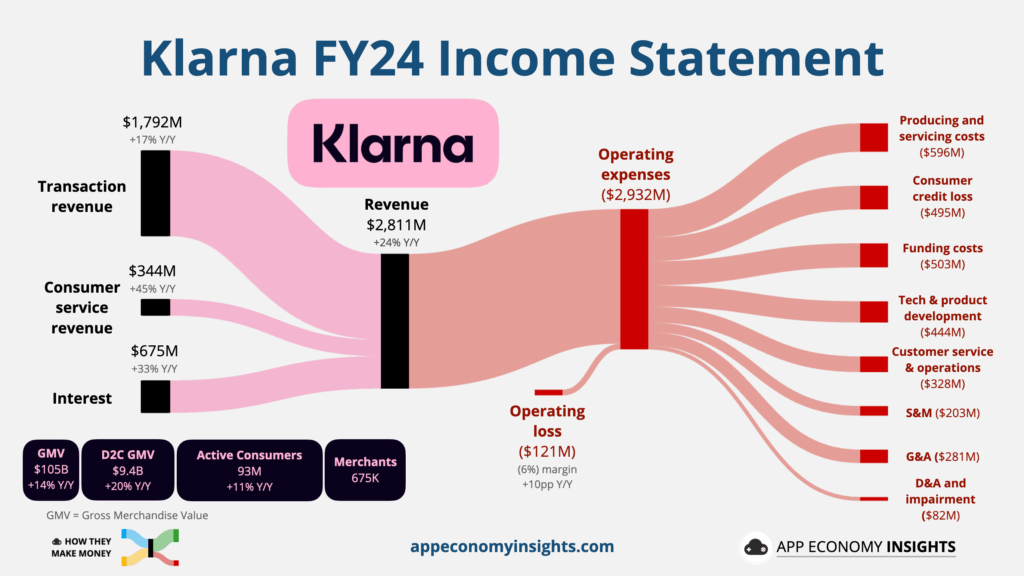

Despite soaring revenues reaching about $2.8 billion in 2024, Klarna struggled to turn consistent profits. Losses mounted during aggressive expansion phases, notably in the U.S. After years of losses, Klarna began cutting expenses and focusing on profitability around 2023.

In 2024, it reported a small profit but slipped back into losses in early 2025 due to rising loan defaults amid tougher economic conditions. This inconsistent financial performance led investors to question the sustainability of Klarna’s business model. Efforts to demonstrate controlled growth and profitability are key for its upcoming IPO.

Impact of Market Sentiment and Investor Skepticism

Investor attitudes shifted drastically from 2021’s enthusiasm to a more cautious stance. The broader tech sector faced sell-offs, especially companies without clear profit paths. Skepticism mounted over BNPL models relying on high consumer credit risk in a rising interest environment.

Comparisons with competitors such as Affirm and Afterpay, who faced their own market challenges, added pressure. Despite its large user base and merchant network, Klarna’s valuation faced downward pressure from these changes in sentiment and market realities.

Klarna’s IPO Plans and Valuation Reset

Klarna’s IPO plans initially targeted valuations closer to its private highs but were delayed due to unfavorable market conditions and external risks like geopolitical tariffs. In 2025, Klarna resumed its IPO filing with a more modest valuation target near $14 billion. The company aims to raise $1.27 billion through its U.S. listing, pricing shares between $34 and $37. This valuation reflects a reset aligned with market conditions and investor appetite for fintech stocks. It also signals Klarna’s maturity as it seeks to balance growth ambitions with profits, aiming to show investors a more sustainable future.

Lessons from Klarna’s Valuation Journey

Klarna’s story offers important lessons about fintech valuation risks. Overvaluation during boom years set unrealistic expectations that market shifts quickly corrected. The company’s trajectory highlights the importance of balancing rapid growth with steady profitability. Changing economic landscapes, regulatory scrutiny, and market sentiment all play a critical role in company valuations. Klarna’s pivot towards sustainable business practices and diversified product offerings shows how fintech firms can adapt in challenging times.

Bottom Line

Klarna’s nearly 70% drop in valuation from its peak underscores the volatility of the fintech sector. Challenges from rising interest rates, regulatory changes, shifting investor sentiment, and profitability struggles reshaped its market value. As Klarna moves forward with its IPO at a more realistic valuation, the company hopes to prove its resilience and long-term potential. Its journey serves as a case study in navigating growth, risk, and market expectations in the fast-evolving world of financial technology.

Frequently Asked Questions (FAQs)

Klarna’s valuation dropped mainly because interest rates rose, rules for buy-now-pay-later services became stricter, and investors wanted profits. These changes made growth harder after 2021.

Klarna aims for a $13 to $14 billion valuation in its 2025 IPO. Shares are expected to sell between $34 and $37 when it lists on the New York Stock Exchange.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.