Why Snow Stock (SNOW) Dropped More Than the Broader Market Today

Snow Stock fell today. It closed at $192.63. This marks a 2.83% drop from yesterday.

Many factors hit Snow Stock hard. The broader stock market dipped less. Investors worry about upcoming earnings.

We see Snow Stock under pressure. Monthly, it lost 8.07%. This outpaces general stock market trends.

What Caused the Drop in Snow Stock

Snow Stock reacts to news. Earnings come on August 27, 2025. People expect changes.

Forecasts show EPS at $0.26. This jumps 44.44% from last year. Revenue hits $1.09 billion, up 24.91%.

Yet, the stock fell. Doubts linger in the stock market. High valuations scare some buyers.

Key Metrics for Snow Stock

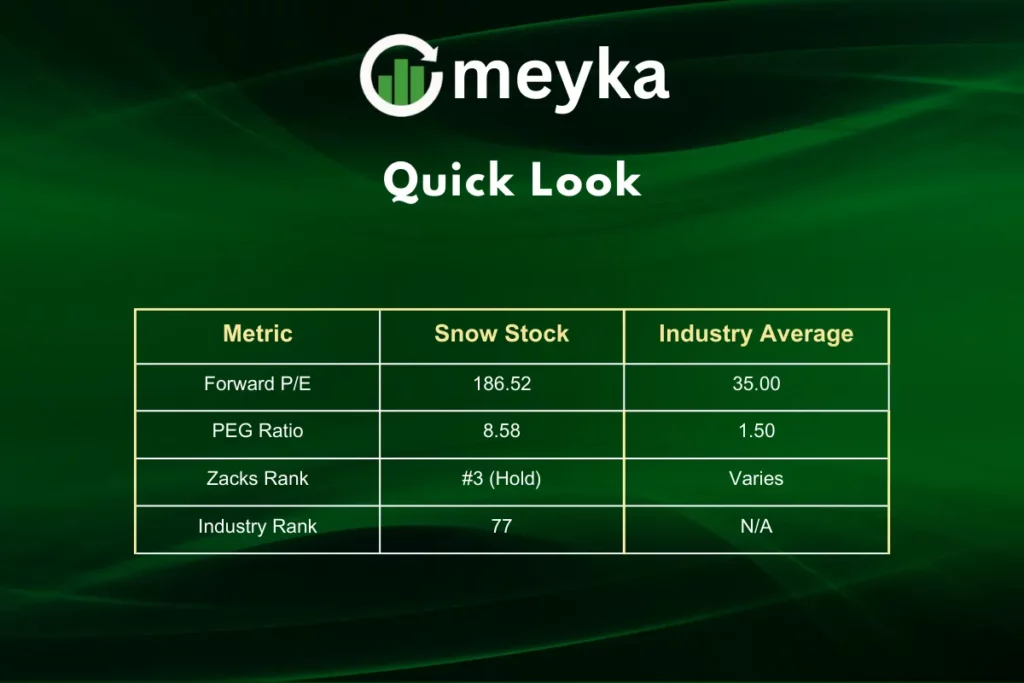

Snow Stock holds a Zacks Rank of #3. This means Hold. It sits in a strong industry.

The Forward P/E stands at 186.52. PEG ratio is 8.58. Both exceed industry norms.

The Internet-Software field ranks 77. It lands in the top 32% of industries. This boosts Snow Stock’s appeal.

Valuation Details

High P/E signals growth hopes. But it risks drops. Stock market watchers note this.

PEG factors in growth. At 8.58, it seems pricey. Compare to peers for context.

Industry averages help. Snow Stock tops them. This draws mixed views from investors.

Industry Rank Impact

Zacks ranks over 250 industries. 77 is solid for Internet-Software. Top 32% means potential.

Strong ranks predict gains. But short-term dips happen. Snow Stock shows this now.

Investors eye these ranks. They guide choices in the stock market. We see patterns emerge.

Upcoming Earnings Outlook

Earnings hit on August 27. Full year EPS at $1.06. Revenue reaches $4.52 billion.

Quarterly jumps look good. 44.44% EPS growth impresses. Revenue up 24.91% follows suit.

Fiscal forecasts build hope. But stock market volatility persists. Snow Stock feels it.

Quarterly Expectations

EPS of $0.26 draws eyes. It beats prior quarters. Growth signals health.

Revenue at $1.09 billion grows fast. This tops last year. Stock market rewards such trends.

We await results. They shape Snow Stock’s path. Investors prepare now.

Full Year Projections

$1.06 EPS for the year. This rises steadily. Revenue at $4.52 billion expands.

Projections fuel debates. High growth versus high price. Snow Stock balances both.

Stock market trends favor growers. Yet, drops like today test patience. We monitor closely.

How Snow Stock Compares to Peers

Peers in software vary. Some hold lower P/E. Snow Stock stands out.

Industry averages sit lower. Forward P/E around 30-40 often. Snow Stock’s 186.52 towers.

PEG norms hover at 1-2. 8.58 raises brows. Stock market pros weigh this.

Comparison Table

We use such data. It clarifies positions. Investors decide based on facts.

Investor Sentiment on Snow Stock

Sentiment mixes hope and caution. Drops like today reflect fears. Stock market moods swing.

Zacks Hold rank tempers hype. It suggests wait and see. Earnings will clarify.

We note monthly 8.07% loss. This exceeds daily 2.83% dip. Trends build over time.

Factors Influencing Sentiment

- Earnings anticipation builds tension.

- High valuations prompt sales.

- Stock market dips amplify effects.

- Industry strength offers support.

These points guide views. Snow Stock navigates them. We track shifts daily.

Long-Term View

Fiscal year ends strong. $4.52 billion revenue impresses. EPS at $1.06 follows.

Industry rank aids. Top 32% bodes well. Stock market favors such spots.

Snow Stock could rebound. Earnings hold the key. We await August 27.

Snow Stock faces challenges in the stock market. We covered the drop and outlook. Key details point to caution.

Disclaimer:

This content is for informational purposes only and is not financial advice. Always conduct your research.