XRP News Today: ETF Buzz vs. Technical Doubts – What’s Next for XRP?

As of November 24, 2025, XRP is back in the spotlight. The crypto world is buzzing with talk about a possible XRP exchange-traded fund (ETF). Many traders see this as a big step that could pull more institutional money into the market. The excitement is real. But so are the doubts.

While social media is full of bold predictions, XRP’s price charts tell a different story. The technical signals still look weak. Momentum is slow. Key resistance levels remain unbroken. This makes some traders wonder if the ETF buzz is enough to push XRP into a strong rally.

At the same time, Ripple continues to expand its global payment solutions. Banks and financial firms still see value in its fast, low-cost transactions. This gives XRP a solid use case that most altcoins lack.

So now the big question stands: Does the ETF hype outweigh the technical concerns? Or is the market moving faster than XRP’s actual performance? The answer may shape what happens next for one of crypto’s most watched assets.

XRP Market Overview

As of November 24, 2025, XRP trades near the $2 mark. Price moved up from lows earlier in the year. The token saw strong inflows after several ETF developments surfaced. Still, daily swings remain large. Traders show a mix of hope and caution. Volume has risen on some days. That increase often comes during ETF-related headlines. Such swings point to high interest and high risk.

The XRP ETF Buzz: What’s Driving the Hype?

Regulatory shifts in 2025 opened new doors. The SEC adopted generic listing standards for crypto ETFs in September. This change makes it easier for funds to list assets on major exchanges. Market participants then speculated that XRP products could follow. That talk turned louder when clearing systems and filings hinted at upcoming ETF listings. Those moves do not mean formal approval yet. But they signal that big firms are preparing for launch.

Several asset managers listed XRP products or filed paperwork. Some exchanges and custodians prepared settlement lines. The market responded fast. Media coverage and influencer posts amplified the story. On top of that, Ripple’s legal clarity in 2025 removed a major barrier. That clarity made institutional conversations more practical. The combined effect boosted demand for XRP exposure through ETFs and funds.

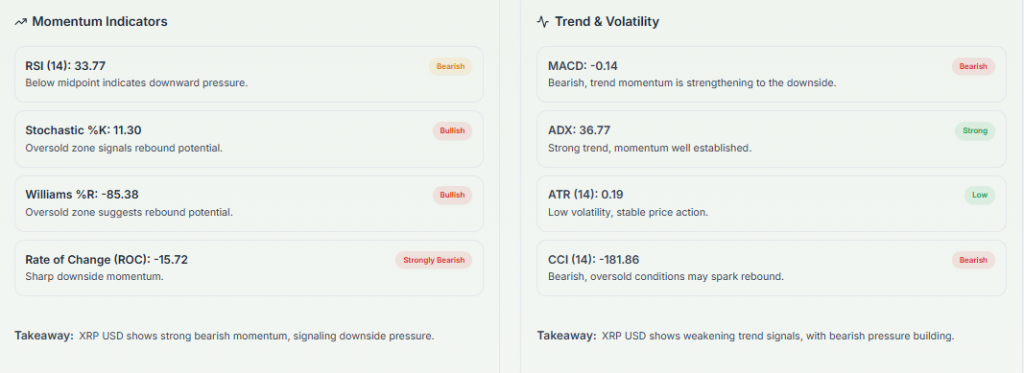

Technical Analysis Raises Red Flags

Charts show mixed signals. XRP broke into higher ranges earlier in November. Then the price pulled back to a decision zone. Momentum indicators do not look strongly bullish. Moving averages are close together. That reduces clear trend confirmation. Several technical traders point to repeating resistance at certain levels. Failure to hold above these levels often triggers sharper drops. Thus, some technical analysts advise caution until clear breakouts occur.

On-chain technicals add nuance. Exchange inflows jumped recently. Dormant whales moved large amounts. Such transfers increased selling pressure on some days. When whales deposit in exchanges, the market often faces a sharper short-term supply. That activity can cancel bullish ETF flows and create price dislocation. Monitoring whale and exchange flows remains critical for short-term traders.

Fundamental Factors Supporting XRP

Beyond charts, XRP retains clear utility. Ripple’s On-Demand Liquidity (ODL) keeps finding partners overseas. Banks and payment firms still test or use XRP rails for fast transfers. That real-world use case is rarer among top altcoins. Legal clarity in 2025 also helped. Courts and settlements reduced uncertainty about XRP’s status in public markets. This removal of legal overhang makes long-term institutional interest more realistic.

An ETF listing would widen access. Retail and institutional investors can buy XRP exposure through regulated wrappers. That tends to reduce custody friction and increase capital flow. However, actual adoption by banks and payment firms depends on compliance, KYC, and internal risk rules. Utility alone does not guarantee instant price gains.

ETF Hype vs. Technical Reality: The Core Debate

Optimists point to the clearing preparations and legal progress. They expect steady inflows once funds go live. ETF listings in other crypto markets set a precedent. Inflows can lift liquidity and raise valuation multiples. Pundits also cite on-chain accumulation as a bullish sign. Recent fund flows into XRP ETFs have shown notable sums.

Skeptics highlight immediate selling from whales. Some large holders sold into ETF demand. That trade can mute rallies. Also, charts do not yet show a clean breakout. The market often prices in expected events before they happen. When the event arrives, traders may sell the news. That pattern could lead to sudden dips even if long-term fundamentals are sound.

What’s Next for XRP?

Short term: expect volatility. Watch the $2.30-$2.50 zone as a resistance area in late November 2025. A sustained move above those levels would signal stronger momentum. If the price falls below $1.80, bears may push toward lower support. Traders should follow daily volume and whale flows closely. Price reaction to ETF listings or DTCC/clearing announcements will be decisive.

Medium term (3-6 months): ETF launches or S-1/S-3 filings will be the main catalysts. Additional Ripple partnership news can help. Also, watch macro liquidity and Bitcoin trends. Crypto flows often track larger market risk appetite. On-chain metrics such as long-term holder accumulation and exchange reserves will shape the trend.

Long term (2026+): institutional adoption and real payments use will matter most. If banks integrate ODL at scale, XRP’s utility case strengthens. ETF access can lock in passive demand. But regulatory shifts and competitive tech remain risks. A clear adoption path could push valuation much higher. Failure to expand use cases may limit gains.

Smart Steps for Handling XRP Market Volatility

Adopt strict position sizing. Use stop losses and clear profit targets. Track on-chain flows and exchange balances daily. Treat ETF chatter as a catalyst, not a certainty. Balance technical signals with fundamental events. For portfolio exposure, consider staged entry. Using tools such as an AI stock research analysis tool can help analyze flows and filings efficiently, but do not rely solely on automation. Always validate automated outputs with primary filings or reputable news.

Final Words

XRP sits at a crossroad on November 24, 2025. ETF preparations and legal clarity support a bullish narrative. Still, technical weakness and whale selling create real short-term risks. Traders should remain alert. Follow ETF filings, clearing notices, on-chain flows, and major partnership announcements. Those signals will decide whether ETF buzz turns into a lasting trend or a short-lived rally.

Frequently Asked Questions (FAQs)

As of November 24, 2025, no XRP ETF is officially approved. Some filings and rumors exist, but regulators have not confirmed anything yet. Investors are still waiting for clear news.

XRP price stays quiet because charts show weak momentum. Some large holders are selling on rallies. ETF talk creates hope, but the market needs stronger demand to move higher.

No one can predict the price with certainty. If an ETF is approved, demand may rise. But price will still depend on market trends, risk levels, and investor interest.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.