XRP News Today: XRP at a Critical Juncture: Bulls Eye $3, Bears Watch $1.58

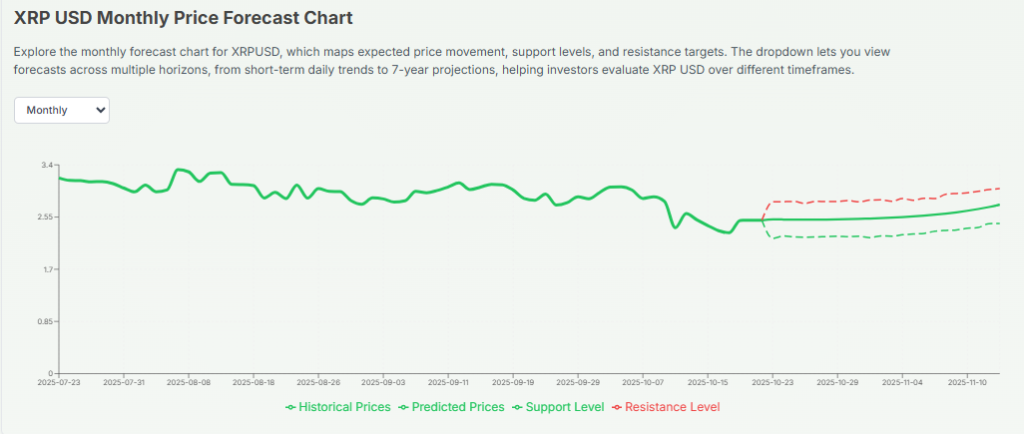

As of October 22, 2025, XRP finds itself at a turning point. The token has recently hovered near the $3.00 mark, an important milestone for bulls aiming higher. At the same time, if momentum fades, the bears are watching a fall toward $1.58, which could mark a deeper slide. Traders and investors are glued to the charts because both sides have strong reasons to act now.

On the bullish side: recent partnerships, regulatory updates, and on-chain trends are fueling hope. On the bearish side: weak volume, broader market jitters, and unresolved legal questions could pull XRP down. In this article, we explore what’s driving the push and pull for XRP.

Let’s break down key price levels, technical signals, and fundamental factors behind its next big move. Here’s the story of how XRP could either surge toward $3 or slip toward $1.58.

Recent XRP Price Performance

XRP climbed and then pulled back in the last few weeks. On October 22, 2025, XRP traded around $2.40 after a volatile run. Daily swings reached roughly the $2.2-$2.55 band in the days before October 22. Volume rose on big moves, but the market failed to hold sustained gains above $2.60.

Bitcoin’s recent retreat and a firmer U.S. dollar added pressure across altcoins. Markets showed that XRP still moves with overall crypto sentiment, but on-chain events and large wallet flows have amplified short-term moves.

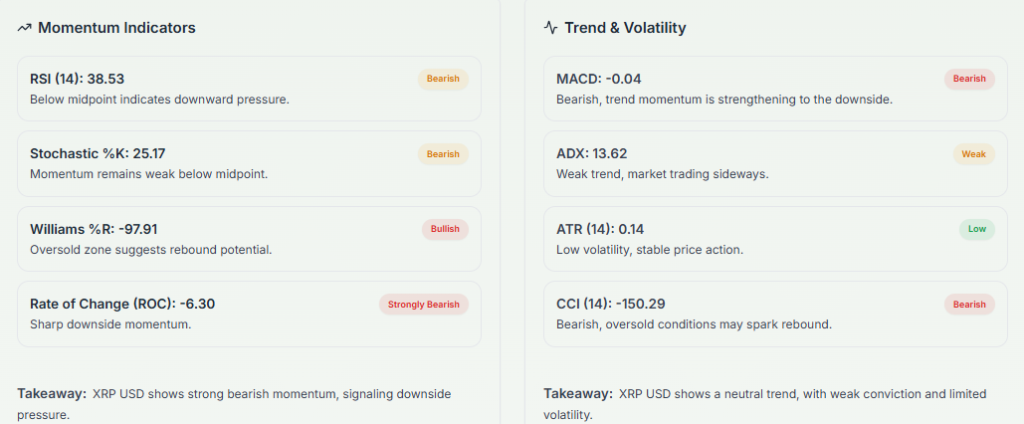

Technical Analysis: Bulls vs Bears

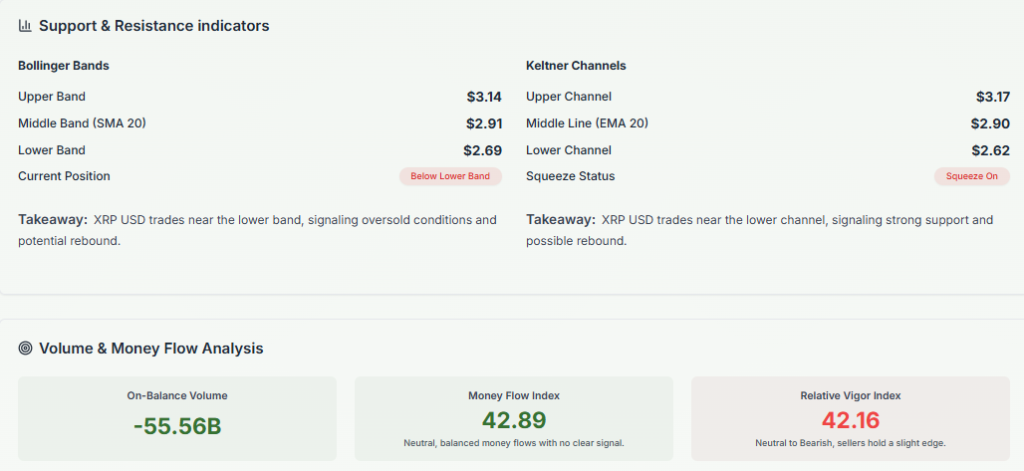

On the bullish side, the path to $3.00 depends on a clear break above near-term resistance at $2.50-$2.60. A sustained close above that zone would signal momentum. Indicators such as rising whale wallet counts and growing accumulation support the bull case. Some analytics showed record highs in whale addresses and notable accumulation around October 21-22, 2025. That pattern can fuel fast moves when buyers step in.

On the bearish side, failure at resistance could send XRP back to key support. The critical support level to watch is $1.58. A drop under $1.80 would risk accelerating selling. Low volume on rallies, larger sell deposits to exchanges, or broader market weakness could push the price lower. Recent whale deposits and heavy outflows at times have intensified dips, proving that large holders can swing prices quickly.

Market Catalysts and Fundamental Factors

Regulatory clarity has been the biggest single driver lately. The SEC-Ripple conflict reached major turning points in 2025. Several legal moves and settlement reports changed investor sentiment earlier in the year. In March 2025, Reuters reported a settlement and reduced fine that shifted risk perceptions. That shift helped institutional interest and lifted buyer confidence. Legal headlines continue to alter risk appetite and dictate whether big funds enter or exit XRP positions.

Institutional adoption also matters. Ripple’s On-Demand Liquidity (ODL) product and new commercial deals boosted claims about real-world use cases. Media reports in October 2025 pointed to increased ODL volume and fresh partnerships. Payment rails that use XRP can cut costs and speed cross-border flows. Continued business wins would strengthen demand if adoption scales.

Technical upgrades to the XRP Ledger are another major force. Developers and the XRPL community proposed and activated amendments in 2025. Several amendments aim to improve privacy, security, and developer tooling. Headlines about five notable XRPL upgrades surfaced in mid-October, which some commentators called a potential catalyst for ecosystem investment and new apps. Ongoing ledger improvements tend to attract developer interest and on-chain activity. Official amendment listings on XRPL.org track each change and status.

Key Price Zones to Watch

First resistance appears near $2.20-$2.60. This area is the first major hurdle before a run at $3.00. Acceptance above $2.60 would point to strength. Support exists at $1.80 and again at the critical $1.58 level. If $1.58 breaks, expect a test of lower anchors around $1.20-$1.30. Watch volume spikes, whale transfers, and on-chain metrics such as wallet growth and exchange inflows. These signals often precede big directional moves.

Expert Opinions and Market Sentiment

Analysts remain split. Some highlight accumulation and ledger upgrades as reasons to be optimistic. Others point to macro headwinds and profit-taking as reasons for caution. Social sentiment swung between hope and fear in late October. Traders used on-chain dashboards and even AI stock research analysis tool outputs to refine risk levels and size positions. Mainstream outlets noted that regulatory clarity has already reduced a major risk premium but not eliminated it.

Future Outlook: Scenarios Ahead

Bull case: If XRP clears $2.60 and keeps steady volume, the route to $3.00 becomes realistic. A confirmed push above $3.00 could target $3.50-$4.00 on momentum and renewed institutional flows. Continued XRPL upgrades and more ODL adoption would strengthen this path.

Bear case: If large holders sell into rallies or macro risk rises, the price could slip below $1.80. A decisive break under $1.58 would likely trigger deeper corrections to around $1.20-$1.30. Negative headlines or major exchange flows could speed this fall. Traders should treat those levels as high-risk triggers.

Wrap Up

XRP sits at a clear crossroads on October 22, 2025. Technical pressure meets real-world adoption and fresh ledger upgrades. Bulls need a sustained move past $2.60 to chase $3.00. Bears need to break $1.58 to force a deeper decline. Monitor exchange flows, whale activity, XRPL amendments, and any new legal or corporate headlines. Those signals will determine whether buyers or sellers hold the next decisive edge.

Frequently Asked Questions (FAQs)

As of October 22, 2025, XRP trades near $2.40. If buying pressure grows and market trends stay strong, it could test $3 soon.

On October 22, 2025, XRP’s key support sits near $1.80. If it drops below that, the next strong support is around $1.58.

The Ripple vs SEC case still shapes investor confidence in 2025. Any positive ruling helps prices, while legal delays or fines can slow XRP’s growth.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.