XRP News Today: XRP Price Action Hints at $5 Target on ETF Speculation

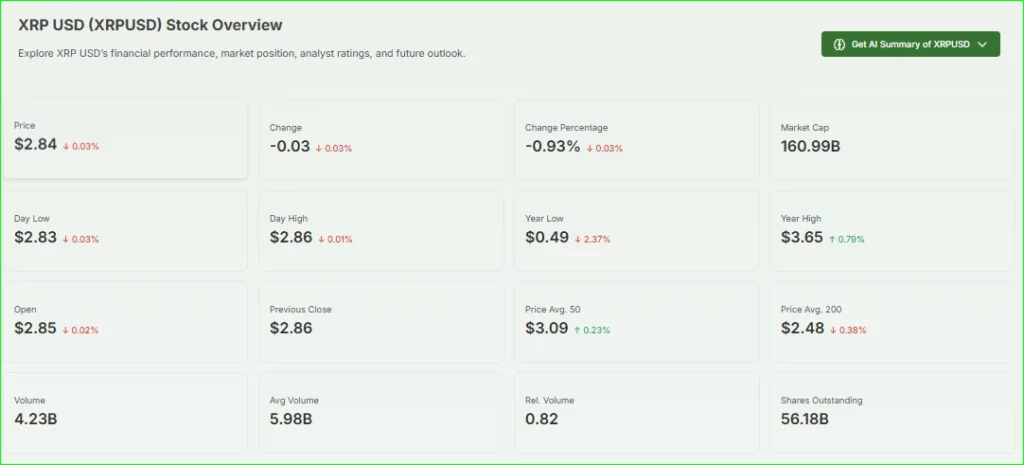

The crypto market is watching the XRP Price closely. ETF talk and bullish charts have pushed traders to imagine a move toward $5. Simple signals and big headlines are driving fast swings. XRP trades around $2.80–$2.85 with a market cap near $168 billion. According to sources, a bull flag pattern and rising ETF odds point to a possible 77% rally if key resistance breaks.

Why is this happening?

XRP Price Analysis

Ripple has been trading in a tight range near $2.75–$2.90. On the daily chart, the token formed a bull flag, a short pause after a strong rise. A daily close above $3 would confirm a breakout and clear the path to $5, Cointelegraph reports. Resistance sits at $3.08 (50-day SMA), and the multi-year high is near $3.66. Support sits near $2.50–$2.75.

What should traders watch?

Technically, bulls need to hold $2.75. If that fails, a retest of the $2.5 zone is likely. Volume and on-chain flows matter too: CryptoRank notes positive net inflows and whale accumulation at current levels, which supports the bullish case if buying continues. Watch the 50-day and 200-day moving averages and the 0.5 Fibonacci level near $2.50 for clues.

Quick price checklist: levels to watch

- Support: $2.50–$2.75.

- Near-term resistance: $3.00–$3.10.

- Key hurdles: $3.40 and $3.66.

- Bull target: $5 if momentum and flows align.

XRP Price ETF Speculation and Market Impact

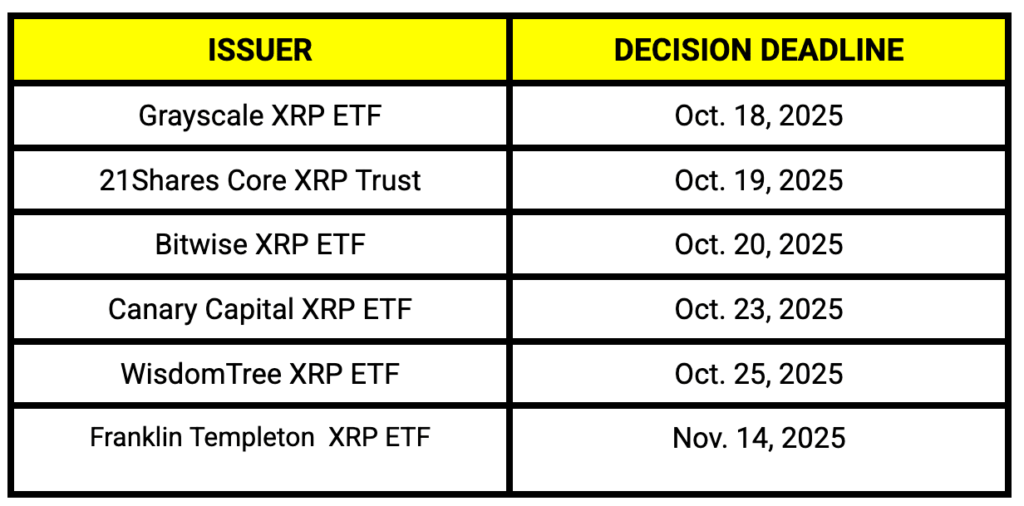

ETF rumors have been a major catalyst. Several large asset managers have filed for spot XRP funds, including Bitwise, 21Shares, WisdomTree, Canary Capital, and Grayscale, and exchanges like Cboe and Nasdaq have acknowledged filings. Cointelegraph tracks a cluster of proposals and notes multiple decision windows that traders are watching closely. Polymarket and other prediction markets have priced approval odds very high, which fuels buying.

Could an ETF move prices fast?

Yes. A spot ETF makes buying XRP through brokerage accounts simple. That can bring steady institutional inflows and larger pools of capital. The Tradable and Polymarket snapshots show approval odds rising into the high 80s and 90s, reflecting strong market belief in an approval outcome, and that belief alone can lift prices.

XRP Price Regulatory Clarity: SEC and CFTC Updates

Regulatory calendars matter. Cointelegraph lists key SEC decision windows between Oct. 18 and Nov. 14 for several filings and notes that more than a handful of ETF proposals sit on the regulator’s desk. The SEC’s rulings, and any CFTC commentary on derivatives, will shape the approval path and trading access for ETFs. Market participants treat these dates as short-term catalysts.

What if regulators delay?

A delay can cool markets and trigger short-term sell-offs. Clear approvals can spark fast inflows.

XRP Price Historical Context and Investor Sentiment

XRP has rallied and corrected many times. Past spikes were tied to legal wins or product news. Today’s ETF talk adds a stronger institutional angle. The Economic Times notes recent consolidation after volatile moves and frames $2.75–$3.20 as the battleground range for buyers and sellers. Traders often compare this cycle to prior rallies where speculation led price, then fundamentals followed.

Is investor mood different now?

Yes. Sentiment now blends retail hype with institutional tools lining up. ETF filings from big managers signal that serious capital could arrive if approvals come.

XRP Price Social Media and Community Buzz

Social feeds amplify moves. Below are three recent posts that shaped chatter:

Ripple’s official post highlighting institutional access to crypto and market maturation.

Paul Barron’s note quoting Canary Capital’s CEO predicting strong initial flows for an XRP ETF.

BloombergTV’s share of Brad Garlinghouse’s remarks on expected ETF development.

XRP Price Expert Opinions and Price Predictions

Analysts and market writers give a mixed but cautious bullish view. Cointelegraph’s technical read suggests a path to $5 if major resistance is cleared. The Tradable highlights prediction markets’ pricing approval as very likely, which supports the inflow story.

CryptoRank adds that on-chain flows and whale behavior are key to sustaining any rally. Togethe,r these sources sketch a realistic scenario where $5 is possible if multiple pieces line up.

What are the timeframes?

Even if approvals happen, the move could take weeks to months. A sudden pump is possible, but a sustained higher price needs consistent demand and ETF trading volume.

XRP Price Risks and Possible Setbacks

There are real risks. Regulatory setbacks, weak ETF demand, or renewed selling tied to Ripple’s monthly escrow releases could drag the price lower. CryptoRank and Cointelegraph flag $2.50–$2.75 as critical downside support. On-chain data sometimes shows Ripple moving tokens back into escrow or releasing monthly allocations, which can increase short-term supply pressure. Traders should size positions carefully and use stops.

Could XRP correct sharply?

Yes. A 20%–30% pullback is possible if sentiment flips or big sellers hit the market. Risk controls matter more than hope. Consider dollar-cost averaging or small position sizes if you plan to hold through volatility.

Investor checklist

- Mark SEC decision dates: Oct 18 to Nov 14, windows can move markets quickly.

- Watch approval odds: Polymarket and market sentiment often lead price action.

- Follow on-chain flows: Net inflows and whale buys support sustained rallies.

- Protect capital: Use stop-losses and size positions for volatility.

- Plan entries: Consider scaling in with dollar-cost averaging.

- Set targets and exits: Know your risk-reward for a move to $5 and for losses to $2.50.

Conclusion: Can XRP Price Reach $5 Soon?

XRP Price has both technical and narrative support today. ETF speculation is the main fuel. If bulls break $3, defend $2.75, and ETFs gain formal approval or clear signals, a move toward $5 becomes plausible over the next weeks to months.

However, the road is narrow: regulatory news, escrow dynamics, and volume will decide the race. Trade carefully, set risk limits, and watch the SEC calendar for the next big trigger.

FAQ’S

Yes, analysts believe XRP Price could reach $5 if ETFs are approved and momentum holds.

Most predictions place XRP Price between $3 and $5 in the near term, depending on ETF approval.

Today, XRP is consolidating around the $2.75–$2.85 zone with bullish sentiment.

An ETF can boost XRP Price by attracting institutional money and making access easier.

Apart from XRP, investors are watching Bitcoin, Ethereum, and Solana for strong setups.

At an XRP Price of $2.80, $100 buys about 35 XRP tokens.

No, XRP Price is not traded directly on Nasdaq, but ETFs may change that.

Disclaimer

This is for informational purposes only and does not constitute financial advice. Always do your research.