XRP News Today: XRPUSD likely to rebounds +6.19% after recent Crypto Market Crash on Oct 13

The crypto market faced a sharp sell-off on October 13, 2025, wiping billions of dollars in value within hours. Bitcoin and Ethereum tumbled, dragging most altcoins with them. Yet, XRP showed surprising resilience compared to many major tokens. While traders panicked, XRP held above key support levels, signaling hidden strength.

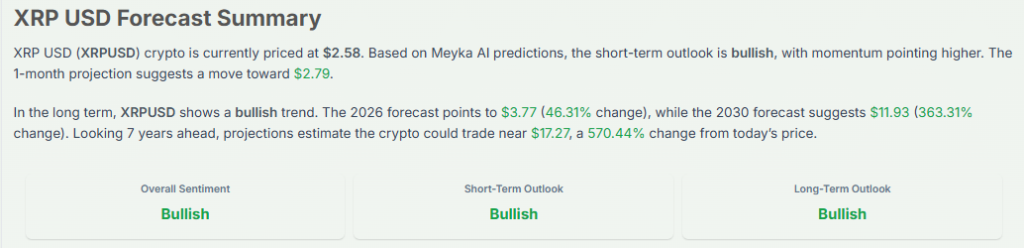

Now, analysts believe XRPUSD may stage a +6.19% rebound as market conditions stabilize. This potential bounce is not just based on hope. It is backed by technical indicators, growing utility in real-world payments, and rising investor confidence.

Ripple’s ongoing partnerships and progress in the SEC case are also boosting long-term sentiment. History shows that XRP has often recovered quickly after sudden drops, turning fear into opportunity. As liquidity returns and buyers step in, XRP could be one of the early movers in the next mini-rally.

Let’s explore why XRP is positioned to rebound, the key price levels to watch, and what traders should expect in the coming days.

Overview of the Oct 13 Crash and Immediate Impact

On October 13, 2025, the crypto market suffered a sharp sell-off. Major tokens fell hard, and liquidity dried up briefly. XRP was hit but later showed a fast bounce. The drop followed macro headlines about U.S.-China trade tensions that spooked risk assets. Traders liquidated positions, and volatility spiked across exchanges. Several sources reported that billions flowed back into the market during the rebound attempt later that day.

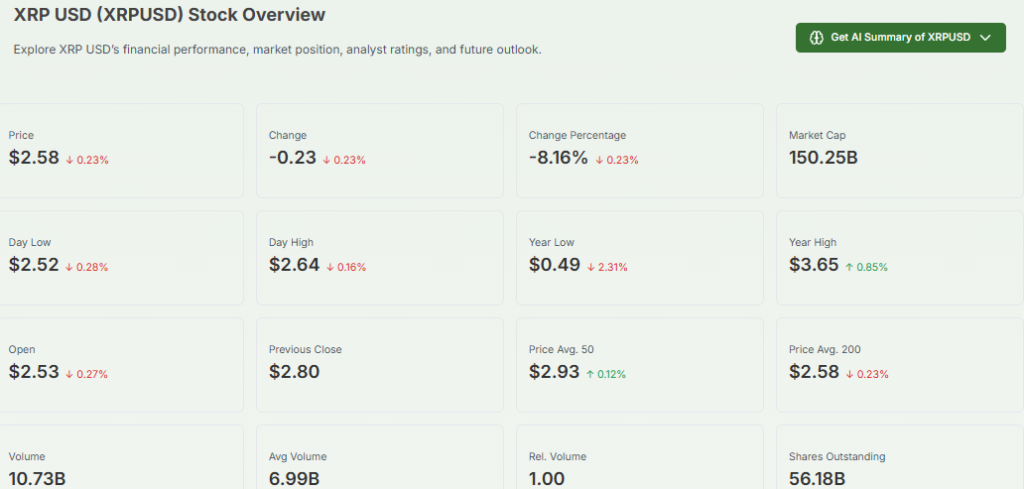

Current Price Analysis of XRPUSD

XRP traded near $2.50 on October 13, 2025, after a sharp intraday swing. Recent data show a low of $2.31 on Oct 12 and a close of $2.56 on Oct 13. Short-term support appears between $2.30 and $2.40. Resistance sits near $2.65, with stronger resistance at the $3.00 level. Volume spiked during the dip and then fell on the first bounce, which suggests buyers entered, but momentum was mixed. Historical daily closes confirm the rapid recovery attempt on Oct 13.

Fundamental Factors Supporting a Rebound

Several fundamentals favor a bounce for XRP. First, XRP remains tied to real-world payment use cases. The XRP Ledger continues to show steady payment activity and wallet growth metrics. Second, institutional interest has increased after regulatory progress earlier in the year. Third, several market commentaries point to renewed ETF and institutional flows into XRP-related products. These drivers can add buying pressure when panic selling eases. On-chain metrics suggest higher user engagement in October, which can support price action if sustained.

Ripple and the SEC: Why Legal Clarity Matters?

Regulatory clarity has been a key catalyst for XRP in 2025. Media and market-tracking outlets reported a favorable turn in the Ripple vs. SEC saga in mid-2025. That shift brought fresh institutional interest. Legal clarity lowers one major source of long-term risk. If further legal noise stays muted, some institutional players may re-enter more aggressively. Conversely, any fresh legal action could reverse sentiment quickly. Traders should treat legal news as a major price driver.

Market Sentiment and Investor Behavior

Sentiment moved from fear to caution within hours on Oct 13. Social chatter showed panic at the low point and then relief as prices recovered. Large wallets, often called whale, were active during the rebound. Several analysis pieces flagged concentrated buying by big holders.

Retail traders seem split between selling to cut losses and buying the dip. This mixed behavior explains the choppy price action. An AI stock research analysis tool also flagged unusual accumulation patterns in on-chain data, which may indicate institutional re-entry.

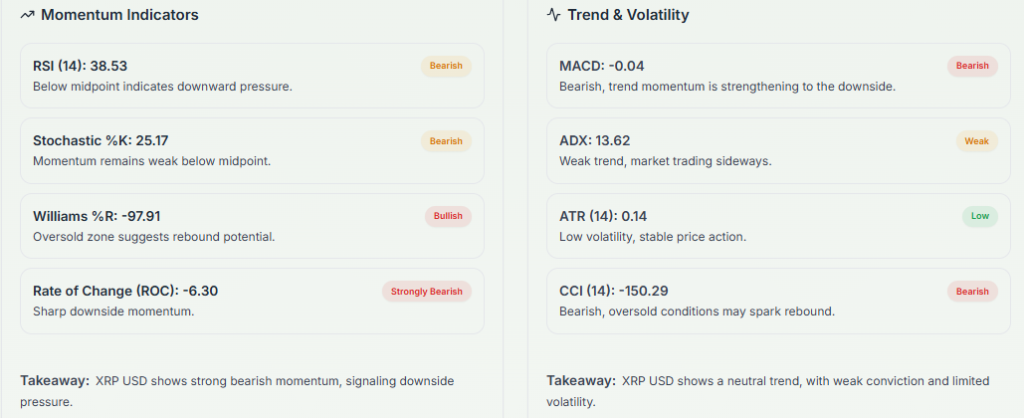

Technical Outlook: Can XRP Rally +6.19%?

A +6.19% move from $2.50 would put XRP near $2.65. That level matches the near-term resistance zone seen on Oct 13 price action. Technical indicators give a conditional green light. RSI had hit oversold territory at the low and then climbed. MACD showed a narrowing of the bearish gap as buyers stepped in. A clean close above $2.65 with rising volume would increase the chance of a follow-through to $3.00. However, low volume on a bounce often means the move lacks conviction and can fail.

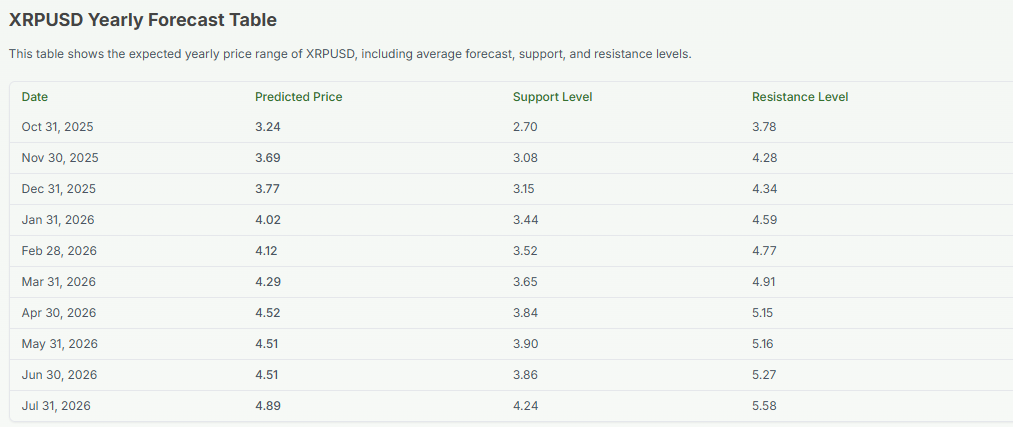

Short-Term Price Prediction and Scenarios

If buyers hold $2.30 support, a typical rebound target is $2.65-$3.00. Conservative traders may expect a retracement to $2.60 first. Bullish traders could push toward $3.00 if volume increases. A failed hold of $2.30 could push XRP back toward $2.00 or lower. Watch for large transfer events on the ledger and major news headlines. Key dates to monitor include upcoming macro announcements and any Ripple regulatory filings.

Long-Term Outlook for XRPUSD

Long term, XRP’s path depends on adoption and regulation. If XRP keeps gaining traction in payment corridors, demand could rise. Institutional flows, potential ETF products, and partnerships would help. Several analyses project higher price targets if the legal backdrop remains stable and demand grows. But competition from other payment-focused tokens and changing macro conditions remain headwinds. Positive structural adoption is the clearest path to sustained gains.

Risks and Challenges

Volatility remains the top risk. One news headline can cause swift reversals. Regulatory uncertainty still exists despite improvements. On-chain activity can be noisy; not all spikes reflect organic use. Macro shocks like sudden trade policy moves also threaten risk assets. Finally, concentrated holdings create the risk of large dumps if big wallets decide to sell. Traders should size positions accordingly.

Investor Takeaway & Conclusion

XRP’s quick bounce after the Oct 13 crash shows resilience. A +6.19% move is plausible if support holds and volume rises. Traders should wait for a clear close above $2.65 for higher-confidence entries. Use stop-losses and size positions to match risk tolerance. Monitor legal updates and on-chain flows closely. If buying the dip, keep the time horizon and exit plan clear.

XRP continues to separate itself from many altcoins through strong utility and growing institutional interest. Market volatility may create short-term fear, but long-term catalysts such as regulatory progress and global payment adoption remain powerful drivers. Patience, disciplined entries, and awareness of key price levels can help traders capture the next breakout. As momentum builds, XRP could become one of the leading recovery plays in the post-crash market cycle.

Frequently Asked Questions (FAQs)

A steady rebound is possible if support near $2.30 holds and volume increases. Major legal or macro shocks could reverse gains.

Use clear stop points below the support. Trade smaller sizes after sudden spikes. Watch volume and major news for signs of real momentum.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.