YMTC Eyes DRAM Market Entry to Expand Memory Chip Footprint

The memory chip market is going through big changes. In September 2025, news broke that Yangtze Memory Technologies Co. (YMTC) is planning to enter the DRAM business. This is a big move because YMTC has been known mainly for its NAND flash products. Now it wants to step into a market ruled by giants like Samsung, SK Hynix, and Micron.

Why does this matter? DRAM is the backbone of modern devices. We find it in our phones, laptops, servers, and even in cars. Without DRAM, speed and performance drop sharply. At present, China imports most of its DRAM needs, which creates both risks and high costs. By entering this space, YMTC is not just chasing profit; it is aligning with China’s goal of self-reliance in semiconductors.

This step won’t be easy. The DRAM industry needs huge investment and advanced skills. Still, YMTC’s move shows how fast the chip race is heating up, and why we should watch closely.

Global Memory Market Landscape

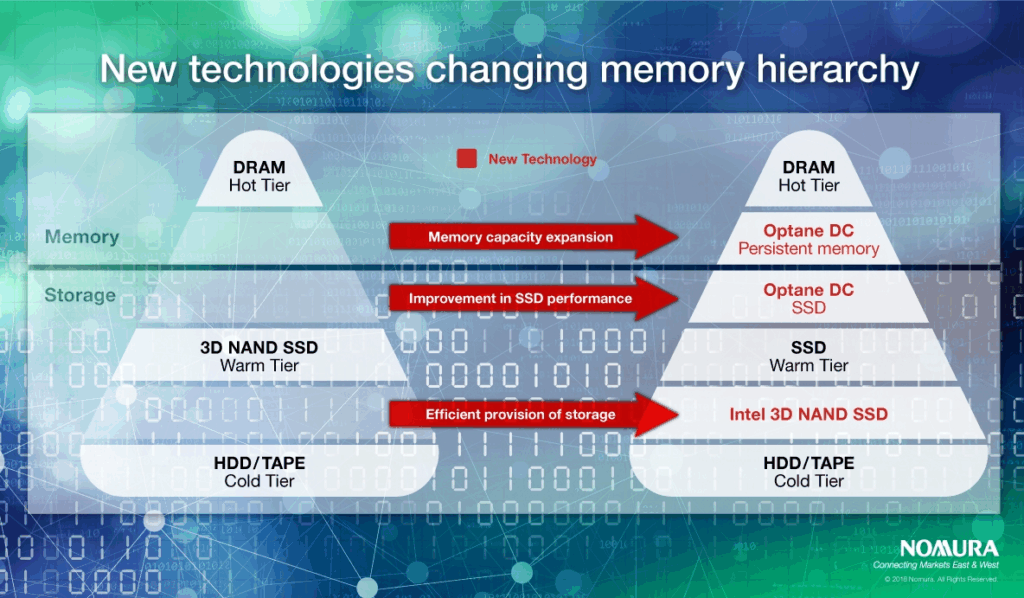

DRAM and NAND serve different roles. DRAM is fast working memory. NAND is long-term storage. DRAM sits in CPUs, servers, and GPUs. NAND sits in phones and SSDs. The DRAM market is big and driven by cloud, AI, and mobile growth. Global leaders include Samsung, SK hynix, and Micron. These firms hold the bulk of DRAM capacity and advanced node know-how.

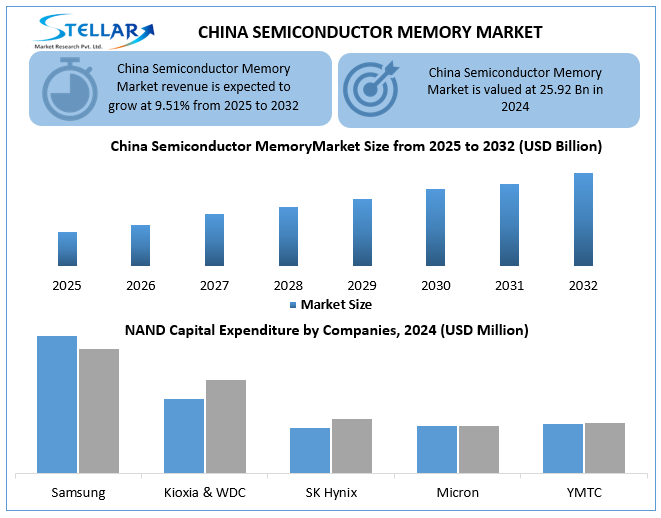

Demand for high-bandwidth memory (HBM) has surged with AI accelerators. Market forecasts show steady growth through the 2020s, led by data center spending. Analysts expect the Asia Pacific to remain the largest regional market.

YMTC’s Current Position in the Memory Industry

Yangtze Memory Technologies Co. (YMTC) made its name in 3D NAND. The company built in-house tech like Xtacking. That gave it speed in stacking dies and higher-density NAND. YMTC grew with strong state backing and big factory builds. The firm later faced export control pressures and supply chain limits. Despite that, YMTC kept expanding capacity in Wuhan and other sites. It now appears ready to move beyond NAND into DRAM and advanced packaging. Recent reporting shows active plans in late September 2025.

Strategic Rationale Behind Entering DRAM

China imports most high-end DRAM. That creates risk for domestic cloud and AI firms. Local DRAM supply would cut import costs and lift security of supply. DRAM types like HBM are vital for AI servers. Producing those chips could support China’s AI push. For YMTC, DRAM offers product diversification. It also spreads technology risk tied only to NAND.

State incentives and large home demand make the move attractive. Investors may re-rate the firm if the firm shows progress. Many investors use an AI stock research analysis tool to track such shifts.

Challenges and Barriers to Entry

DRAM is not just another memory. It uses different process steps and IP. The learning curve is steep. Investment needs are huge. Building competitive fabs and R&D costs billions. Global incumbents hold many patents and decades of process know-how.

Access to high-end lithography and advanced packaging tools is also limited by export rules. U.S. and allied export controls on advanced chip gear raise a real constraint. Even with strong funding, closing the performance gap can take years.

Potential Partnerships and Support

YMTC can tap local partners for speed. Reports mention cooperation with CXMT (ChangXin) on HBM. CXMT has DRAM experience and is already scaling DRAM lines. YMTC brings hybrid bonding and 3D stacking skills. State financing and supplier networks can supply capital and packaging links. Collaborations with foundries and OSAT (outsourced assembly and test) firms will help. Academic centers can also speed IP creation. Still, foreign tool access and global certification remain uphill battles.

Industry and Market Implications

If YMTC makes DRAM at scale, prices could be affected. New capacity often eases supply tightness. That can push down ASPs (average selling prices). Global leaders might face margin pressure. China’s overall import bill for memory could fall if domestic DRAM gains share. The move may also change supplier choices for smartphone and server makers in China. At the same time, the geopolitical angle could deepen. Trade partners may respond with tighter controls or pressure on equipment vendors. Competitors might protect markets via pricing or IP actions.

Expert Views and Analyst Insights

Analysts warn that building competitive DRAM takes time. Some expect a five-year work plan before volume, others longer. Past attempts by new entrants show the path is costly and uncertain.

Still, analysts also note a strong market pull: China’s DRAM import dependence creates a steady demand base. A successful domestic DRAM supplier would be a major strategic win. Independent market trackers like Omdia and industry commentators highlight that HBM and other AI-oriented DRAM classes are the most valuable targets for newcomers.

Future Outlook

Short term: YMTC will likely focus on pilot lines and packaging tests. Medium term (2–5 years): expect pilot production for niche DRAM products like HBM or LPDDR classes.

Long term: The firm may aim at mainstream DDR if tools and IP gaps close. The biggest risks remain access to advanced tools and global market acceptance. If sanctions or export rules tighten further, tech progress may slow.

On the flip side, steady state backing and alliances with domestic DRAM players could speed the journey. Watch for formal announcements and factory certifications through late 2025 and into 2026. Noted reporting on September 24-25, 2025, first highlighted these plans.

Final Words

YMTC’s bid to enter DRAM is bold. The move targets a clear market need in China. Success is possible but far from certain. The path needs deep investment, hard technical work, and stable supply lines. The global memory map may shift if domestic Chinese DRAM becomes viable. For now, the story is one to watch closely through the end of 2025 and beyond.

Frequently Asked Questions (FAQs)

As of September 2025, YMTC is still planning DRAM production. Experts say pilot output may start within three to five years, if technology access and funding stay steady.

YMTC wants to reduce China’s heavy import needs. Entering DRAM also diversifies products and supports growing demand for AI servers, smartphones, and cloud systems, as reported in September 2025.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.