Zerodha Faces Outage: Traders Report Prices Missing on Platform

Zerodha Faces yet another technical disruption, leaving thousands of traders across India struggling to access real-time price data. As one of the largest discount brokers in the country, Zerodha has become a go-to platform for millions of retail investors.

However, frequent outages and missing stock prices raise serious concerns about reliability, especially during peak trading hours when decisions must be made in seconds.

What Happened During the Zerodha Outage?

On a busy trading morning, users logged into Zerodha’s Kite platform only to find that live stock prices were missing or showing incorrect values. Traders who rely on accurate stock market data were left in the dark. While some could see partial information, many reported that entire sections of their watchlists displayed blanks.

The outage forced traders to either pause their positions or shift temporarily to other platforms. For those involved in fast-moving instruments like derivatives or AI-related stocks, even a few seconds of delay can mean the difference between profit and loss.

Why Reliability Matters for Retail Traders

Zerodha holds a massive share of India’s retail brokerage market. Its affordable pricing, powerful charts, and strong stock research tools attract beginners and seasoned investors alike. But when Zerodha faces an outage, trust takes a major hit.

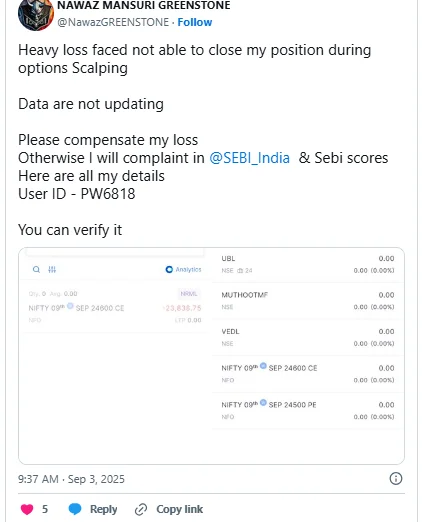

For intraday traders, reliability is everything. They buy and sell based on small price movements, relying on platforms to provide second-by-second updates. Missing or delayed prices mean they are essentially blindfolded. Some traders reported having open positions they couldn’t exit due to inaccurate feeds.

The Indian stock market is expanding at a historic pace, with new investors joining daily. As more people look to invest in equities, mutual funds, and AI-driven stocks, platforms like Zerodha must step up their technological game.

Potential Causes Behind the Glitch

While Zerodha has not released a detailed technical explanation, experts suggest that outages of this kind typically result from:

- Server overloads during high-volume trading sessions.

- Data feed disruptions from stock exchanges like NSE or BSE.

- Software glitches in order management or price display systems.

- Cloud infrastructure issues are affecting multiple users at once.

Brokerages that handle millions of transactions per second need advanced infrastructure. Even a slight lag in system response can snowball into missing data for users. Other Indian brokers have faced similar issues, but given Zerodha’s dominance, its outages hit the hardest.

Impact on the Stock Market Community

The outage was widely discussed on social media. Traders vented their frustrations with screenshots showing missing prices. Some even compared Zerodha with other brokers, questioning if it was time to migrate.

Beyond just inconvenience, the incident also sparks regulatory concerns. SEBI, India’s market watchdog, emphasizes investor protection. Repeated platform outages can draw scrutiny, as brokers must ensure uninterrupted access.

How Traders Can Protect Themselves

When Zerodha faces such issues, traders need a backup plan. Here are a few strategies:

- Have accounts on multiple platforms so trades can be executed if one fails.

- Use stop-loss orders to limit exposure during unpredictable glitches.

- Rely on exchange apps like NSE Mobile or BSE apps for live price confirmation.

- Avoid over-leverage when platform instability is frequent.

While Zerodha continues to innovate, retail traders cannot afford to place all trust in a single platform. Diversification is not just for portfolios but also for trading infrastructure.

Zerodha’s Response and Future Outlook

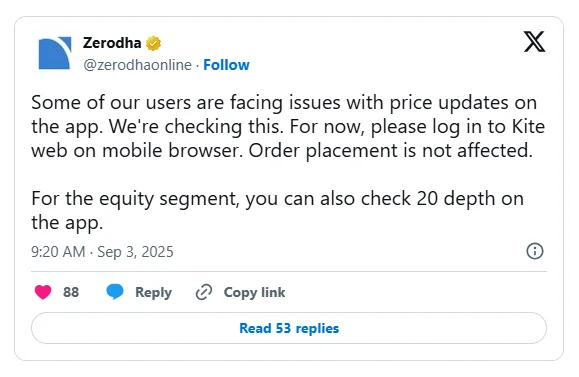

Zerodha acknowledged the issue on its official X (formerly Twitter) handle, stating that the glitch was due to a technical error with data feeds. The company assured that its engineering teams were working on a fix. Still, the reassurance did little to calm traders who had already missed critical opportunities.

Zerodha has historically been transparent with its users, often publishing detailed blogs on system upgrades and challenges. However, as the Indian stock market becomes more sophisticated and competitive, reliability will be a key differentiator.

What This Means for Indian Stock Market Growth

India’s financial ecosystem is witnessing a digital transformation. Retail participation is growing at record levels, partly due to platforms like Zerodha making trading accessible. But with opportunity comes responsibility.

When Zerodha faces outages, it underscores the urgent need for better infrastructure in the brokerage industry. The stock market cannot afford to lose investor trust due to technical failures. As India’s equity landscape expands, technology-driven brokers must ensure round-the-clock reliability.

Conclusion

The recent outage that Zerodha faces, missing prices, has once again highlighted the fragility of online trading platforms. While glitches are part of digital growth, their frequency raises concerns for millions of traders who depend on real-time access.

Zerodha remains a leader in India’s brokerage industry, but maintaining trust will require faster upgrades, transparent communication, and seamless technology. For traders, the lesson is clear, always have a backup and never rely solely on one platform when navigating the fast-paced stock market.

FAQs

The outage occurred due to technical issues in its price data feeds, likely linked to exchange connectivity or server overload. Zerodha has acknowledged the issue and promised fixes.

Traders should keep backup accounts with other brokers, use stop-loss orders, and cross-check prices directly from exchange apps to avoid heavy losses.

Yes, SEBI monitors broker reliability. Repeated outages can draw scrutiny, and brokers may be required to upgrade systems to protect investors.

Disclaimer:

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.